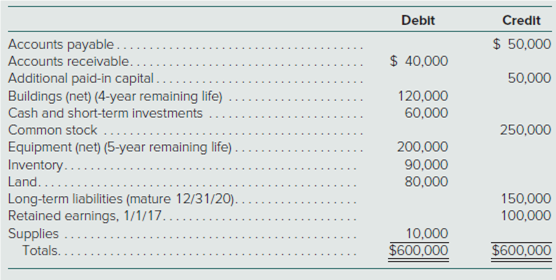

Last month, the company acquired $50,000 worth of meat from a nearby processor, $13,000 of condiments from a wholesaler, and $24,000 in buns from a local bakery.Īll of these transactions were credit-based, with Frank's Haute Dogs needing to pay off each shipment by the end of the following month. Accounts payable liabilities examples Scenario #1įrank's Haute Dogs is a growing food truck business that makes the city's tastiest gourmet hot dogs, brats, and frankfurters. These two values should regularly be compared, with any variances quickly identified and resolved. And the aggregate total of this subsidiary ledger - which will reflect your total accounts payable - will ideally match the line-item entry for A/P in your company's general ledger. Often, this unified record will be in the form of an A/P subsidiary ledger, which documents the corresponding transaction history and amounts owed to each supplier and vendor.

And as your company pays off the loan, each payment would then be recorded as a credit to your cash account and a debit to your A/P.

#Accounts payable debit credit update#

So if you were to take out an $8,000 loan to fund the update of critical equipment, you would debit your cash fund for the loan total (because there was an increase in the overall value of this particular asset) while also crediting your A/P account for the same amount (because there was an increase in the amount of money owed by your business). With assets, however, you would credit any decrease in the asset's value and debit any increase. For liabilities, any increase in the amount of a company's total debt is reflected as a credit, and decreases are noted as debits. To further explain, within double-entry bookkeeping, any transaction made by a business will be recorded as two matching entries - a debit and a credit - on the balance sheet. And any manipulation of those entries will occur as a debit (a decrease in total) or a credit (an increase in total) to the associated asset or liability account. Some common liabilities your business may hold include:īoth assets and liabilities will appear as line items within your general ledger as well as on your balance sheets. Routinely these financial obligations are classified as either current liabilities that need to be paid in the next year or as long-term liabilities that are due after more than 12 months. And since A/P catalogs the money that your business owes to suppliers and vendors for credit-based purchases that weren't made with cash up-front, accounts payable is listed as a liability. What is a liability?Ĭonversely, liabilities are related to funds that are leaving your company - specifically outstanding debts you need to pay. Intangible assets: Non-physical resources such as intellectual property, trademarks, patents, and cryptocurrencies. And typically, assets are classified into one of four categories:Ĭurrent assets: Items that can be liquidated into cash within a short period of time (usually within 90 days but can be up to a year).įixed assets: Physical goods - like property or equipment - that aren't routinely sold but can grow your business's value.įinancial assets: Any bonds, stocks, securities, or other investments held by the company. Put simply, an asset is anything that holds a financial value - e.g., cash, equipment, customer debts, property - that is owned by your business. Understanding assets and liabilities What is an asset? Glad we could help! But if you're asking this question, we're going to guess that you're likely new to the finance world, and a more thorough discussion of assets, liabilities, and accounts payable (A/P) might be useful.Īfter all, you might want to understand why A/P is considered a liability - beyond taking our word for it - and how that fact might impact how you handle and monitor these types of transactions. If that's all you needed to know, fair enough. Short answer: accounts payable is a liability.

0 kommentar(er)

0 kommentar(er)